Monthly Market Insights | December 2022

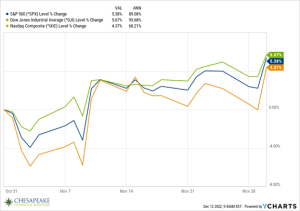

US Markets

Stocks surged higher in November on rising optimism that the Fed would slow down future interest rate hikes.

The Dow Jones Industrial Average gained 5.67%. The Standard & Poor’s 500 Index picked up 5.38% and the Nasdaq Composite rose 4.37%. Value stocks continued to outperform the market during the month of November.

A Determined Fed

As expected, the Federal Open Market Committee (FOMC) ended its November 1-2 meeting announcing its fourth consecutive 0.75% hike in federal funds. In the accompanying statement, the FOMC suggested a potential easing in subsequent rate hikes.

Stocks rallied on the news but did an abrupt reversal when Fed Chair Jerome Powell struck a much more hawkish tone in his post-meeting press conference. Losses accelerated into the following day, cementing a poor start to the new month.

Inflation Report

The markets turned around the following week, however, when a lower-than-expected inflation report triggered the biggest one-day stock market gain in more than two years. The report revived hopes of a slowdown in the pace and size of future rate hikes. The tech-heavy Nasdaq gained 7.4% for the day.

As the month progressed, public comments by Fed officials appeared to pour cold water on investors’ hopes. Despite these hawkish comments, stocks rallied during the holiday week and picked up momentum following the release of the FOMC meeting minutes the day before Thanksgiving.

Powell Confirms

The meeting minutes suggested that an imminent easing in rate hikes may be in the offing. The minutes revealed that most Fed officials felt a slowdown in the pace of rate hike increases was appropriate. Fed officials pointed to the growing risk that the Fed may increase rates beyond what was required to reduce inflation.

Stocks surged higher to close out the month after comments by Powel that the Fed was prepared to ease up on coming rate hikes.

Sector Scorecard

All 11 industry sectors were positive for the month, with gains mainly in Materials (11.7%) and Industrials (7.81%). Energy only increased 1.28% during the month due to Russian price cap discussions, and OPEC remains cautious regarding oil production.

What Investors May Be Talking About in December

In the month ahead, the financial markets will again focus on the Fed as it concludes its two-day meeting on December 14. November’s 0.75% increase in the federal funds rate marked the fourth consecutive 75 basis points hike since June.

Inflation appears to be trending lower, and the job market is showing signs of cooling, which may help influence the Fed’s decision. The Fed has prepared the financial markets for its next move, so it’s unlikely to change course.

It’s an open question whether the November Consumer Price Index, which will be released on December 13, will impact the Fed’s decision.

Investors should pay close attention to Fed Chair Powell’s comments following the FOMC’s announcement. In November, stock prices rallied after the release of the meeting statement, only to reverse course on Powell’s hawkish tone in response to reporters’ questions.

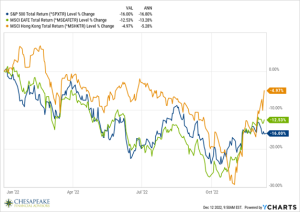

World Markets

Overseas markets rallied in November as the MSCI-EAFE Index picked up 11.08%.

Pacific Rim markets were strong, with Australia climbing 6.13% and Japan adding 1.38%. China’s Hang Seng index had a sharp rally, picking up 26.62%.

Indicators

Gross Domestic Product (GDP)

The second reading of 3Q22 GDP was revised higher, to 2.9% from 2.6%.

Employment

Employers continued to hire, with payrolls rising by 261,000 in October. While this is a strong number, it was down from 315,000 in September. The unemployment rate ticked higher to 3.7%, while average hourly earnings rose 4.7% from a year ago.

Retail Sales

Retail sales rose 1.3% in October, driven by increased purchases of oil, food, and drink. This report will be closely monitored as we head into a critical holiday shopping season for many businesses faced with higher costs and consumers dealing with higher prices and increased borrowing charges.

Industrial Production

Industrial production fell 0.1%, coming in lower than the consensus forecast of an increase of 0.1%.

Housing

Housing starts declined by 4.2% in October, dragged down by single-family home starts, which reached their lowest level in nearly two-and-a-half years. The year-over-year decline was 8.8%.

October’s existing home sales fell 5.9% from their September levels and 28.4% from a year earlier as higher mortgage rates drove potential buyers out of the market. It was the ninth consecutive month that sales fell.

New home sales unexpectedly jumped 7.5% in October, despite higher mortgage rates. Sales were down 5.8% from a year ago. The median price of a new home was $493,000, which rose 15.4% from last October’s level.

Consumer Price Index (CPI)

Inflation moderated in October, rising 0.4% month-over-month, and reported below market expectations of 0.6%. The 12-month rate remained elevated at 7.7% under the consensus estimate of 7.9%. Core inflation (excluding the energy and food sectors) was 0.3% month-over-month in October, which was lower than the projected 0.5%.

Durable Goods Orders

Orders for goods expected to last three years or longer were up 1.0%, exceeding economists’ expectations of a 0.4% increase.

The Fed

The Federal Reserve announced a 0.75% rate hike in federal funds at the conclusion of its two-day November meeting of the Federal Open Market Committee (FOMC). In the statement accompanying the announcement, the FOMC said that future rate increases would consider the cumulative monetary tightening to date and the lag in the impacts resulting from such tightening.

In his post-meeting conference, Fed Chair Powell added that it was too soon to consider any slowdown in the pace of rate hikes and that the terminal rate may be higher than originally expected.

In the November meeting minutes released just before Thanksgiving, Fed officials indicated that they were likely to slow the pace of rate hikes soon, suggesting that such slowing may begin with December’s meeting.

ONE ADVISOR | TWICE THE ADVICETM

Give us a call to speak with our expert advisors at (410) 823-5442 or email invest@peakeadvisors.com.

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf